Building A Diversified Fund Portfolio: A Comprehensive Guide For Investors

In today's unpredictable financial markets, building a diversified fund portfolio has become an essential strategy for investors seeking stability and growth. Whether you're a beginner or an experienced investor, diversification helps mitigate risks and maximize returns. By spreading investments across various asset classes, sectors, and geographic regions, you can create a balanced portfolio that aligns with your financial goals.

A diversified fund portfolio is not just about owning a wide range of assets; it's about strategically allocating your investments to optimize performance. This approach ensures that if one asset underperforms, others may compensate for the loss, providing a safety net for your financial future.

In this article, we will delve into the intricacies of building a diversified fund portfolio, exploring key strategies, asset allocation techniques, and best practices. By the end of this guide, you'll have a clear understanding of how to construct a portfolio that aligns with your risk tolerance and investment objectives.

Read also:P Diddy Height Discovering The Iconic Rapper And Entrepreneurs Real Height

Table of Contents

- What is a Diversified Fund Portfolio?

- The Importance of Diversification in Investing

- Understanding Asset Allocation Strategies

- Types of Funds in a Diversified Portfolio

- Managing Risks in a Diversified Portfolio

- Effective Strategies for Diversification

- Tools and Resources for Building a Diversified Portfolio

- Real-World Examples of Diversified Portfolios

- Tips for Beginners in Diversified Fund Portfolio Management

- The Future of Diversified Fund Portfolios

What is a Diversified Fund Portfolio?

A diversified fund portfolio refers to a collection of investments spread across different asset classes, sectors, and geographic regions. The primary goal of diversification is to reduce risk while enhancing potential returns. By avoiding overexposure to any single asset or market, investors can protect their portfolios from significant losses during market downturns.

Key Components of a Diversified Fund Portfolio

- Equities: Stocks from various industries and regions.

- Bonds: Fixed-income securities offering stability.

- Real Estate: Investments in property or REITs.

- Commodities: Assets like gold, oil, and agricultural products.

- Alternative Investments: Hedge funds, private equity, or cryptocurrencies.

Building a diversified fund portfolio requires careful consideration of your financial goals, risk tolerance, and investment horizon. This ensures that your portfolio remains aligned with your long-term objectives.

The Importance of Diversification in Investing

Diversification is a cornerstone of sound investment strategies. It helps investors manage risk effectively by spreading investments across various assets. When one asset underperforms, others may offset the losses, providing a more stable portfolio overall.

Benefits of Diversification

- Reduces Volatility: Minimizes the impact of market fluctuations.

- Enhances Returns: Increases the potential for higher returns over time.

- Protects Capital: Safeguards your investments during economic downturns.

Investors who neglect diversification often face higher risks and may experience significant losses during market turbulence. By incorporating diversification into your investment strategy, you can build a resilient portfolio capable of withstanding various market conditions.

Read also:Addison Vodka Insta A Comprehensive Guide To The Viral Sensation

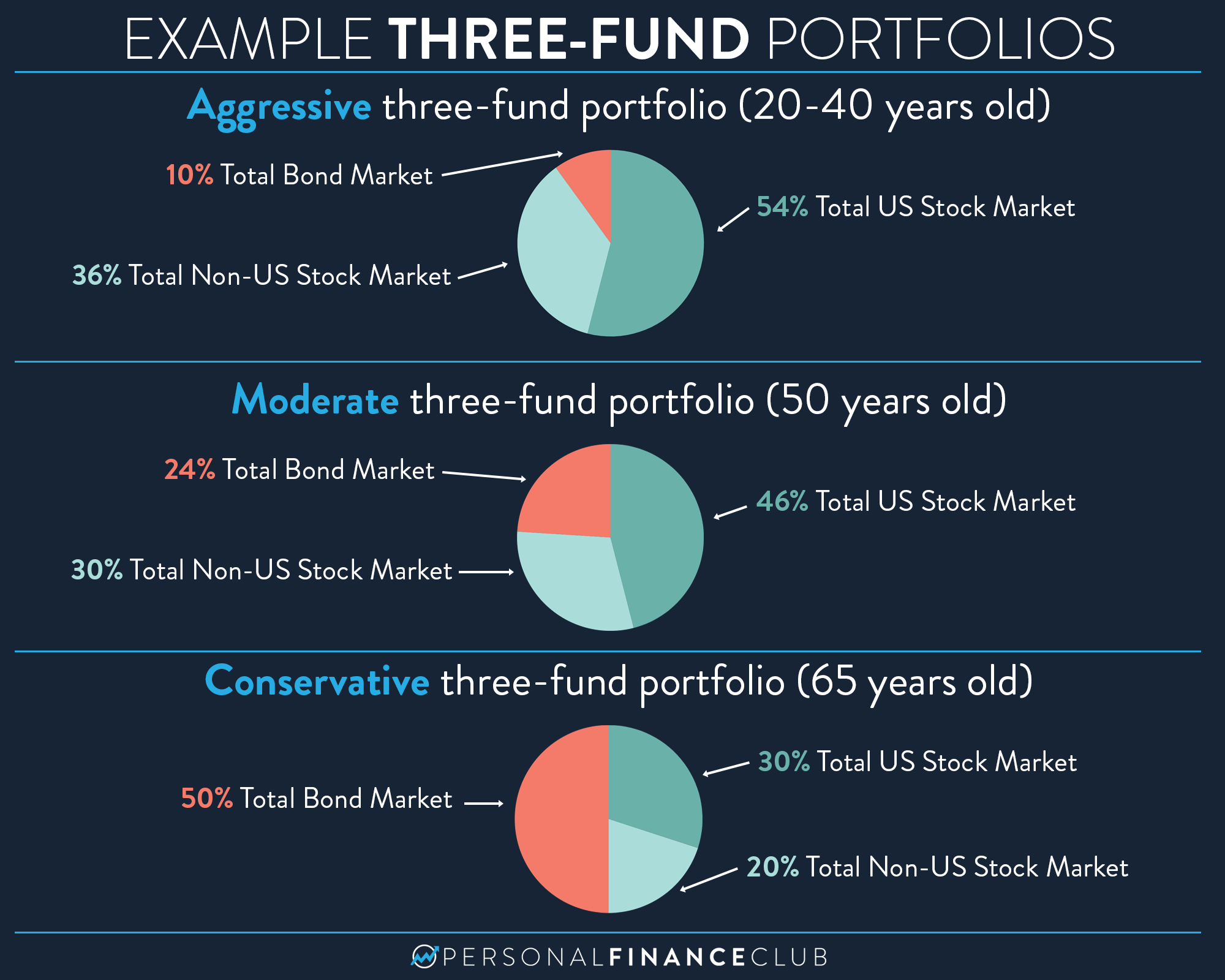

Understanding Asset Allocation Strategies

Asset allocation is the process of distributing investments across different asset classes based on your financial goals, risk tolerance, and time horizon. Effective asset allocation is crucial for building a diversified fund portfolio that aligns with your objectives.

Common Asset Allocation Strategies

- Strategic Asset Allocation: Maintaining a fixed percentage of assets over time.

- Tactical Asset Allocation: Adjusting allocations based on market conditions.

- Dynamic Asset Allocation: Actively rebalancing the portfolio to capitalize on market opportunities.

According to a study by Vanguard, asset allocation accounts for approximately 88% of a portfolio's performance variability. This highlights the importance of developing a well-thought-out asset allocation strategy to maximize returns while managing risks.

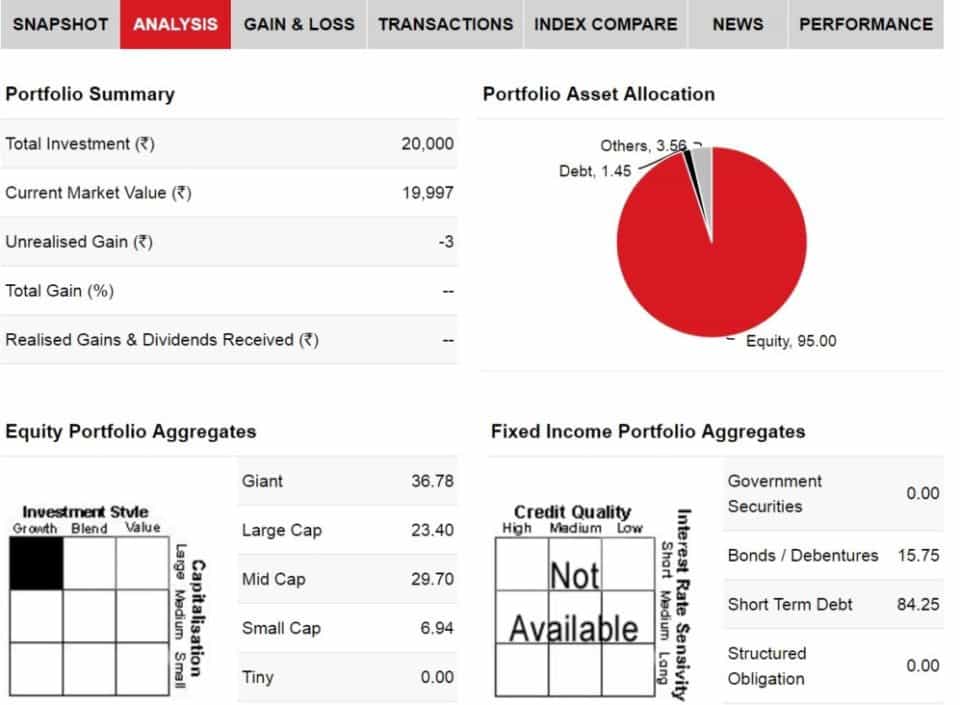

Types of Funds in a Diversified Portfolio

A diversified fund portfolio typically includes a mix of different types of funds, each serving a specific purpose. These funds cater to various investment goals and risk profiles, ensuring a balanced and comprehensive portfolio.

Categories of Funds

- Equity Funds: Invest in stocks for growth potential.

- Bond Funds: Focus on fixed-income securities for stability.

- Index Funds: Track market indices for passive investing.

- Exchange-Traded Funds (ETFs): Offer flexibility and diversification.

- Money Market Funds: Provide liquidity and low-risk returns.

Selecting the right mix of funds depends on your investment objectives and risk tolerance. For instance, younger investors may prioritize growth-oriented equity funds, while retirees might focus on income-generating bond funds.

Managing Risks in a Diversified Portfolio

While diversification reduces risks, it does not eliminate them entirely. Investors must understand the potential risks associated with their portfolios and implement strategies to manage them effectively.

Types of Risks in Investing

- Market Risk: Fluctuations in asset prices.

- Credit Risk: The possibility of default by bond issuers.

- Liquidity Risk: Difficulty in selling assets quickly without affecting their price.

- Inflation Risk: Erosion of purchasing power over time.

To mitigate these risks, investors should regularly review their portfolios, rebalance allocations, and consider hedging strategies. Staying informed about market trends and economic indicators also helps in making informed investment decisions.

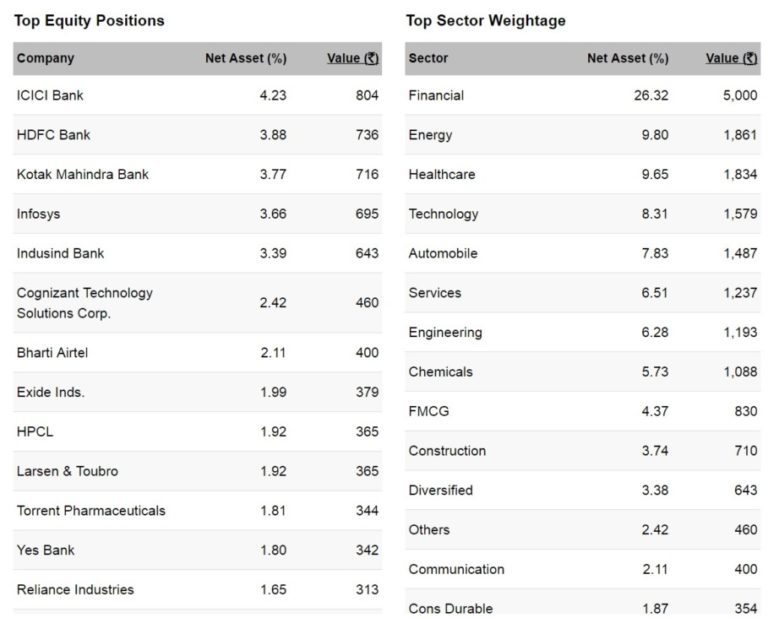

Effective Strategies for Diversification

Implementing effective diversification strategies is crucial for building a successful fund portfolio. These strategies involve selecting a wide range of assets and maintaining a balanced allocation across them.

Strategies for Diversification

- Global Diversification: Invest in assets from different countries to reduce geopolitical risks.

- Sector Diversification: Spread investments across various industries to minimize sector-specific risks.

- Size and Style Diversification: Include large-cap, small-cap, growth, and value stocks for a well-rounded portfolio.

Research from Morningstar suggests that globally diversified portfolios tend to outperform domestic portfolios over the long term. By incorporating international investments, investors can tap into emerging markets and benefit from global economic growth.

Tools and Resources for Building a Diversified Portfolio

Various tools and resources are available to help investors build and manage diversified fund portfolios. These tools provide valuable insights into market trends, asset performance, and portfolio allocation.

Popular Tools for Investors

- Robo-Advisors: Automated platforms offering personalized investment advice.

- Portfolio Management Software: Tools for tracking and analyzing portfolio performance.

- Financial News Platforms: Sources for staying updated on market developments.

Utilizing these tools can enhance your ability to make informed investment decisions and optimize your portfolio's performance. Additionally, consulting with financial advisors can provide expert guidance tailored to your specific needs.

Real-World Examples of Diversified Portfolios

Examining real-world examples of diversified portfolios can provide valuable insights into effective diversification strategies. These examples demonstrate how investors successfully manage risks and achieve their financial goals.

Case Studies

- Case Study 1: A young professional investing in a mix of growth stocks, international ETFs, and bond funds.

- Case Study 2: A retiree focusing on income-generating assets like dividend-paying stocks and government bonds.

These case studies highlight the importance of tailoring diversification strategies to individual circumstances and objectives. By learning from successful investors, you can refine your approach to building a diversified fund portfolio.

Tips for Beginners in Diversified Fund Portfolio Management

For beginners venturing into diversified fund portfolio management, here are some essential tips to consider:

- Start with a clear investment plan outlining your goals and risk tolerance.

- Invest in low-cost index funds for broad market exposure.

- Regularly review and rebalance your portfolio to maintain optimal allocations.

- Stay informed about market trends and economic indicators.

Building a diversified fund portfolio is a journey that requires patience, discipline, and continuous learning. By following these tips, you can establish a solid foundation for your investment success.

The Future of Diversified Fund Portfolios

The future of diversified fund portfolios looks promising, with advancements in technology and evolving market dynamics shaping the investment landscape. Innovations such as artificial intelligence and blockchain are transforming the way investors approach diversification.

Emerging Trends

- Increased adoption of ESG (Environmental, Social, and Governance) investing.

- Growth of digital assets and cryptocurrencies in diversified portfolios.

- Enhanced data analytics for better portfolio management.

As the financial world continues to evolve, staying adaptable and informed will be key to thriving in the realm of diversified fund portfolio management.

Kesimpulan

Building a diversified fund portfolio is a strategic approach to investing that offers numerous benefits, including risk reduction and enhanced returns. By understanding asset allocation, selecting the right funds, and implementing effective diversification strategies, investors can create portfolios that align with their financial goals.

We encourage you to take action by starting your journey in diversified fund portfolio management. Leave a comment sharing your thoughts or questions, and explore other articles on our site for more insights into the world of investing.